Is bank failure anachronistic?

The world is seeing an unusually high level of focus on the financial condition of its banks including leading global institutions. What is causing banks in distress?

Whilst for some of us the concept of bank failure is almost anachronistic it is something that can occur in some countries. In many countries, however, there are mechanisms to protect the clients of banks, such as insurance, or a culture in which weaker players are absorbed into stronger players so the only parties who lose are the shareholders.

Over the last months, we have seen 1) the 16th largest bank in the United States fail and effectively be sold before it hit the ground, 2) a global name, Credit Suisse, having to stop trade emerge with UBS and 3) a loss of confidence in Deutsch Bank a pillar of the German economy.

Confidence is the name of the game

Banking is a business which relies on confidence. At Projects RH several of our clients move what is to them -and to most people- large amounts of money offered to parties they don’t know, this is done through relationship banks, where their bank knows the bank of the party on the other side. The whole process, whether it is the sale of assets or the purchase of goods, relies on confidence. Within our community, any disturbance in this confidence can either stop a transaction or make it more time-consuming as banks need to be substituted due to credit limits and competencies changing.

Three factors have led to this loss of confidence.

- A change in bank cultures where rather than relationship-based they moved to high yield transaction-based business models. It is less about the relationship and more about the fees.

- Bankers complying with the rules in how they report; that reporting technically the correct number which in fact hides the truth.

- Banks losing focus on their traditional business as they look for a new revenue streams. We are now wanting banks to stick to the knitting – not insurance, stock broking, travel….

Today banking is under the microscope

The business of banking has come under the microscope because interest rates have risen globally. This means:

- Portfolios of long dated low-yield securities are effectively worthless. Someone argued that this doesn’t matter because the end value of the security will be the same event is held to maturity. The classic example of this is a 10-year government bond. For simplicity’s sake let us say it has a face value of $10 and it was issued at par with the coupon of 1%. The same bond today if issued would have a coupon of 3%. The older bond if it was to be sold today is worth far less than $10. Whilst if it doesn’t have to be sold, the bank will simply have a low revenue. If it does need to be sold and it forms part of its tier 1 capital the bank will not have $10 to pay clients or have $10 with the securities to give to the central bank as its lender of last resort.

- Central banks around the world are only showing signs of increasing interest rates which will make this gap grow. In short, on any marker market basis banks are looking at a capital loss but of securities.

- Most banks took low coupon loans from central banks to lend money to the business sector during the years of Covid-19. Such central banks are now requiring those facilities to be repaid and the cost of these new facilities from the market are at higher interest rates reflecting the market today.

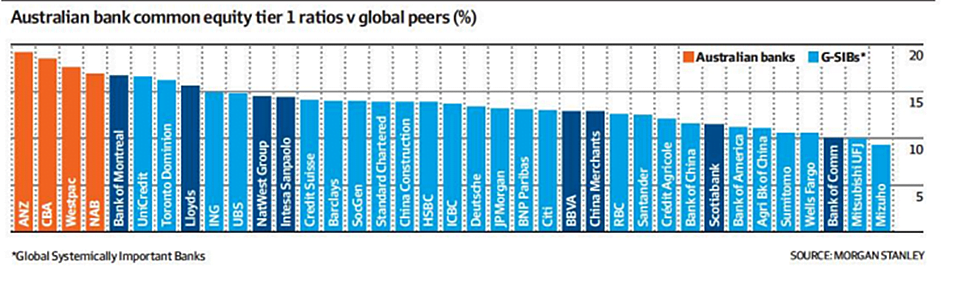

The banks with the most risk do not have the most capital.[1]

Today’s Issues

- How many more banks have bonds which I have not marked to market and if called upon would not get $10 for their existing securities?

- How many deals have been done with parties simply to earn fees where the banks truly do not understand the client and may mean that they have poor assets or have given poor assets to other institutions.

Becoming a transaction driven Bank

Most international banks are at their heart relationship- driven. Clearly there are exceptions which are transaction banks such as Goldman Sachs and Macquarie Bank. However, when we look at the large institutional banks who often use our own money (either shareholders’ funds or depositors’ funds) in the deal they need to be doubly careful and to manage the culture.

Historically, particularly in the United States, investment banking has been separated from large institutions which were fundamentally community and customer bankers. This separation was maintained until 2000 when the large retail banks acquired investment banks. In the US, this separation had been required under the Glass Steagall Act (1929-1999). Globally this saw many well capitalized banks establish investment banking arms (e.g. BNP, HSBC, Citibank and Deutsch Bank).

Adopting a new focus

For those in the know, in the events of Credit Suisse there were clearly no surprises and were related to a decision in 2000 to appoint a new CEO who focused on technology and cost-cutting. Credit Suisse’s traditional model had been labor intensive relationship banking at the high-net-worth individual level, a service provided around the world. Unfortunately for Credit Suisse their high-net-worth individual clients did not want Robo banking and lower levels of service. Perhaps without really knowing it, Credit Suisse turned away from its traditional wealth management business without seeing what it was doing. In short, this was its key problem with the movement in interest rates only bring it to everyone’s attention.[2]

Back to “normal”

At least one of these problems can be easily corrected by making banks publish their positions on a mark to market basis. For more than 20 years most banks have produced a daily forward-looking position statement which is referred to as value at risk. This tells bank management what they expect to happen and the impact upon the banks position. Most large institutions produce this daily so the impact of interest rate movements should be understood by all executive management. If banks should need more capital, they should be required to raise it now before interest rates rise yet again.

Banks need to match the maturity of their assets and liabilities. Of course, this is easier said than done but banks need to be in the market adjusting their portfolio on a regular basis to ensure that the mismatch between assets and liabilities is small.

The second of these issues can be cushioned by requiring separate operations and reporting on commercial and consumer banking vis investment banking.

By Paul Raftery, CEO, Projects RH, Sydney.

If you have any questions, please call +61 418 486 015.

——————————-

Bibliography

- Grenville, S.; “Bond maturity mismatch exposes the error of near-zero rates”, The Australian Financial Review, 3/29/2023.

- Source : Poijak, V.; “Big four lead global bank capital rankings” The Australian Financial Review, 3/31/2023.

- Walker, O. and Morris, S.; “Why Ermotti got retapped to steer UBS”, The Australian Financial Review, 3/31/2023.

- Weinman, A.; “Deutsche Bank went ‘transactional’”, The Australian Financial Review, 3/29/2023.