Project Management – Investment banking: Problems and Solutions for the Australian Payments System.[1]

Australia’s greatest shortcoming is banks do not transfer all funds for value promptly. It depends on the bank and which technology you can access and with the same bank this commonly varies on different platforms. Projects RH banks with the NAB (one of big4 pillars) and if we pay from a PC, payment can take 1-3 days, whereas if we pay from the same account off a phone it takes 30 seconds using the Osko system[2].

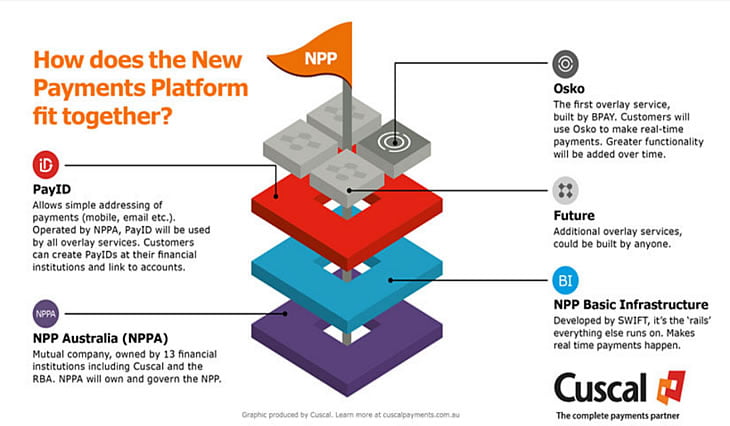

This failure of the payments system is an example of financial power, it should have been corrected in March with the merger of three bank-controlled technologies PayID, BPAY and Osko (see infographic).

Projects RH – Project Management – Investment banking

In my role as CEO of a medium size consulting firm that works in corporate finance / investment banking / project management, we need to pay staff and subcontractors etc. We also need to know we have been paid by our clients. We still don’t know if we have been paid or not until it appears on my phone.

In paying bills, we still use debit cards from our phones which is causing audit issues. It is requiring we keep high balances in our accounts which has a cost.

Most small firms face the same issues. Our business accounts don’t get the 2% rebate I get on my personal account or airmiles.

The major Australian banks have the technology but act like a cartel. They are seeing a real challenge from the Neobanks and foreign banks. I personally bank with HSBC as I get free FX and multicurrency banking plus rebates but not airmiles.

The cost of our global banking is also too high. We are establishing accounts in Singapore to overcome some costs!

————————————————–

[1] The Author is currently undertaking “ The Economist Fintech and the Future of Finance: Blockchain, Cryptocurrencies, Govcoins and the Payments Revolution”, a program offer by The Economist Education and GetSmarter. (May-July, 2022). This program inspired this paper.

[2] See https://www.westpac.com.au/personal-banking/online-banking/making-the-most/new-payments-platform/osko-by-bpay/

[3] Source https://www.cuscalpayments.com.au/news/articles/real-time-payments-gets-real-with-brands-unveiled/

Here is how Australian banks can transfer all funds for value promptly

The biggest impact I have seen is coming from CredAbility Systems (CS) which Projects-RH is advising.

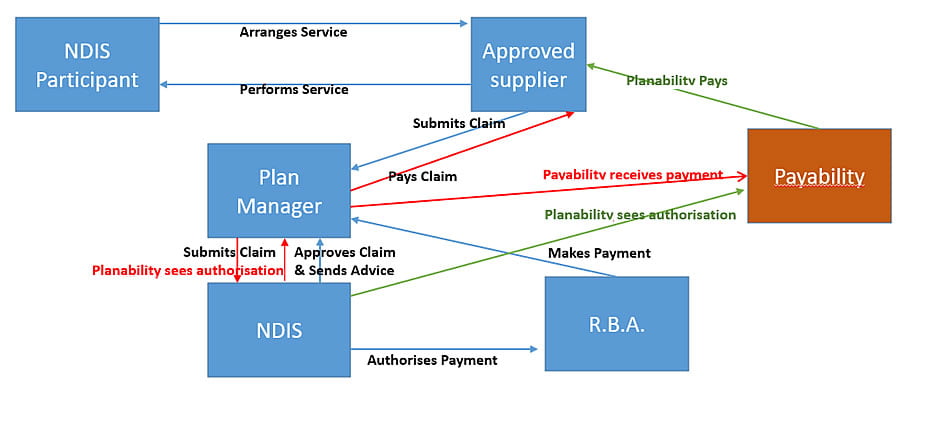

Australia has an AUD 45 billon pa (USD 32 billion) National Disability Insurance Scheme (NDIS) funded by the Federal Government. Each participant is given an agreed amount allocated to categories and periods. 260,000 participants have a Plan Manager (PM). The PM manages services and budgets – every payment, however, needs on -line approval.

CS has developed a system which generates requests, knows when the NDIS has approved payment (usually in a few seconds), and can pay an approved supplier the same day. The supplier pays 1% plus 50c – like a credit card or Stripe payment fee. CS’s subsidiary, Payability, has a financial services licence, credit licence and a regulated fund. Payability bridges the payment from Reserve Bank (RBA) to the Plan Manager and then the supplier.

[4] CredAbility Systems presentation, Sydney, 31-05-22.

The inefficiency of the existing system lies in the NDIS giving real time approvals but does day-end payment instructions to the RBA, and then these are paid to the Plan Manager the next day, who needs to do a reconciliation and make payments within 5 business days. The RBA pays 1050 Plan Managers daily, not suppliers. CS is the bridge.

This innovation allows businesses to manage their cash flow on a same day basis. Most of the suppliers are small businesses – e.g.; gardeners, drivers, therapists…

This is actually delivering one of the goals of the NDIS – fast payments. It is great business for Projects-RH!

See you next time.

By Paul Raftery – CEO of Projects RH

Corporate Finance – Project Manager – Investment banking

Sydney, July 2022