What if Crypto Currency became Valueless?

Satoshi Nakamoto (a pseudonym) was the anonymous founder of a peer-to-peer distributed financial system which existed outside regulatory environment. Bitcoin was the financial product which emerged. Despite many books[1], investors, capital investment project managers and users of the system have wanted institutions to assist them in accessing trading and even have it on their smartphones. It is now far from the founder’s dream.[2] Its worth is impacted on by influencers.[3] We are now living in the aftermath of the proposed scenario.

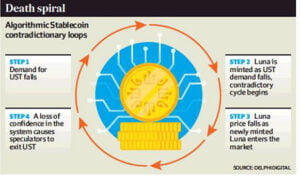

The proposed scenario was called Crypto’s $85b death spiral is a new kind of bank run[4]

Let’s define the concept of bitcoin falling significantly and this occurring across the spread of cryptocurrencies (a contingent effect such as occurred earlier this year with Terra/Luna).[6] The concern is an expanded version of the contingent effect of what happened. 1) Algorithmic trading would occur in the crypto currency markets first triggering stop/losses and selling based on gearing requirements being broken. This includes contaminating other coins[7]. 2) Sell downs on Funds holding Crypto and companies with high exposure to settlement risk. 3) Listed crypto companies 4) Sell-off and closure to finance sector companies with a high exposure – PayPal, Visa, Stripe etc. 5) Many crypto firms are retrenching – right sizing.[8]

In reality is it not just volatility, the reason so many “invest” in “crypto”. As Leo Abruzzese said, in the Head Tutor Module 3 welcome, crypto has not achieved its object of being a currency (a medium of exchange), a unit of account or a store of value but is rather an asset class.[9] [10] The adoption of Bitcoin as currency in El Salvador needs to be seen in a local context.

In June, 2022, why did this not happen? 1) All cryptos are not these same and real stablecoin are just that. (This does not stop the demand for CBDC and for disclosure standards for listing on exchanges.[11]) 2) Banks and central banks had minimal exposure. 3) Major funds are portfolios and had less than 10% of the FUM in the sector. It was a bad haircut day – not burning the Central Bank day.

Most of the so-called investors and speculators and they are likely to lose their money. Many are leveraged and are likely to either be closed out or end up with a financial loss.

For most of the ecosystem who are not trading as principles they will see their FUM reduced but the institutions should largely remain. The exception to this may be small specialist exchanges and listed portfolio managers whose underlying assets may become worthless.

The global economy as a whole, in the speculative view of crypto currencies, it is simply a bad hair day. At this point in time, and I suspect over the long haul, crypto currencies are a commodity like oil, coal, lithium… It will not result in a dramatic correction in the economy.

Whilst all crypto is not the same there is still considerable misunderstanding of the many types of securities which are described as simply crypto. Also, all “stablecoins” are not alike or stable. Algorithmic coins backed by another coin are not stable.[13]

None of the cryptos are units of accounts or stores of value per se. It is like a speculative purchase of gold.

Locally the article in the financial daily had the headline “Cypto meltdown after $26b terra collapse”.[14] The real concern was contagion.

The established financial community has had to react to the growing interest in crypto due to its threat not only to the attack on profitable product lines but on their market share generally. In many countries, including Australia the large banks which are heavily regulated have had to react to shareholder concern about their lack of activity in the crypto space. Today:

- Banks have their own fintech departments

- They invest into fintech and host incubators

- Buying companies and talent (including compliance)

- They trial products in other markets

- They form collaborative groups.[15]

Banks need meet the demands of regulators and shareholders – they will not overexpose into crypto. The example of Mellon BNY is typical – relatively small and seen as profitable.

Whilst it is becoming a significant asset class, the volatility of Cryptocurrency has not resulted in significant impact across global economies.

At the time of writing stories of contagion continue[16] and many will lose money. For the reasons stated above, in summary bitcoin is not a widely held store of wealth the contagion will be limited to bitcoins and associated stock but there will be a short-term impact on other tech stocks, the sun will rise in the morning.

No doubt crypto currency will continue to be of great interest and ownership of it will continue to spread as an asset class but is unlikely ever to come the dominant medium of exchange because:

- It is volatile

- it is not a unit of account

- it is not a store of value

- it is not of limited supply

- significant amounts of money are not exiting the banking system for coin.[17]

Centuries ago, the transfer of gold was how global debts were settled. Since this time the concept of a currency has had the idea of the government behind it – fiat. Very idea the first crypto currencies was to exclude government.

Capital strategy for crypto projects

For crypto teams facing volatility, expert capital strategy is vital. Projects RH provides tailored capital raising consulting services to refine investor decks, structure tokenomics and navigate compliance—helping projects become investor-ready and resilient against market shocks.

As CEO of Projects RH, and specialized in capital investment project management, I believe that if crypto currencies do have any meaningful involvement in the development of financial systems and it will be necessary for sovereign crypto currencies to become the mainstream (CBDC). So, if we have central bank to draw currencies and continue to have financial institutions holding our wealth, I suspect will simply become another card on the digital wallet in my phone. Already today I can pay from my phone 12 currencies and a negligible cost.

Why might consumers and firms choose bitcoin over traditional currencies? What would be the pros and cons for them in doing so?

Pros

- Settlement speed and reduced cost

- Not need approvals – avoiding anti-money laundry rules

- They will get caught as the money needs eventually go into the banking system.

- To minimize income and sales tax.

Cons

- Illiquidity during closed sessions

- Cotangent from tech products.

- Banning orders and special tax investigations.

Which traditional financial firms can cryptocurrency companies replace, and which can’t they replace?

- Can replace

- ATMs

- Mortgages

- Payment mechanisms

- Can’t replace

- Banks to convert into local currency to pay bill – guarantees.

- Mortgages

- ATM/s

- Clearance of government payments

- Confidence products – Crypto has no lender of last resort / Central Bank – Repo Window.

- Banks – Performance Bonds

- Trade finance and documents (inc LC’s)

- Custody of cash (trust / stability)

How would bitcoin’s dominance affect individual components of the traditional financial system, such as central or commercial banks?

In the unlikely scenario that crypto became the dominant means of settlement / medium of exchange it would dramatically impact on the banks’ ability to create and lend new money and correspondingly deny central banks access to an effective monetary policy. It would leave government only with fiscal policy to influence the economy. It is unclear how governments would fund deficits. One would expect governments would be forced to issue CBDC via the banks, Applying Gresham’s Law CBDC’s would replace other coins for traditional finance. CBDC’s would be like current digital money. Other coins, like NFT’s would continue.[19]

One of the original “virtues” crypto currencies was that the transactions were unknown to government and outside tax net. It is already clearly not the case for crypto currency traded in Australia as gains and losses are recorded in the draft of your tax return provided to you by the Australian government. In effect it is already being treated like any other financial institution transaction.

Whilst the number of our clients accept crypto currency payments (Bitcoin and Ethereum) such payments are immediately converted into a stable currency- I don’t see this trend changing.

To be a threat to the global financial system bitcoin would need to first be a medium of exchange and store of value. My view is colored by my lived experience if I want to convert AUD to GBP, we theoretically sell AUD to buy USD and sell USD to buy GBP. We need a stable reserve currency – no crypto/bitcoin meets this criterion. We do use crypto but the exposure is for seconds – literally sell AUD buy USDCoin, sell USDCoin buy GBP. Why would we do this – timing, spreads and bank fees.

For there to be a real stable coin we will need a true CBDC. The decision by China in April 2021 to ban trading of crypto coins has been significant not only in stopping Mainlanders investing outside Greater China but in closing miners. Unless China is part of it you will not replace fiat currencies. China is trailing a digital Won but it does not need to be a crypto. [20]

For banks and central banks bitcoin will cause some storms but they are having to embrace technology and change regulation putting the financial system on notice. They too must evolve (whilst being strong and stable). Mellon BNY was recently joined by its biggest competitor, State Street, in using the technology tokenise and generally use the blockchain technology.[21] During the GFC Central Banks re-asserted their control and at least in Australia the banks are accepting their role (exiting funds management and insurance for example). These banks will only expose a small part of their balance sheet to crypto risk whether it be as a trader, proprietary trader, settler. If crypto has a 100% equity rating vis 4% for mortgage lending and 8% for commercial lending the returns for crypto will need to be unrealistically high (and certain) for banks to invest.

Until we have CBDC crypto will always have a second place. It reminds me of Indonesia were in the 2010’s I carried local currency for small local purchases also used USD for significant purchases like jewelry. The process of unbundling will continue, and the banks will be impacted by cherry picking.

See you next time!

By Paul Raftery,[22] CEO Projects RH – Sydney 2022

———————————————

[1] Drescher, D.; Blockchain Basics: A Non-Technical Introduction in 25 Steps, Apress, Frankfurt am maim, 2017 and www.blockchain-basics.com, 23rd July, 2021.

[2] Laurance, T.; Blockchain for Dummies, Wiley, 2nd Edition, New Jersey, 2019 esp. p. 46.

[3] “Elon Musk problem”, Twitter, https://www.youtube.com/watch?v=lxTtA4bPEKg – Influencer.

[4] “Crypto’s $85b death spiral is a new kind of bank run”. The Australian Financial Review, 27th May, 2022 at https://todayspaper.smedia.com.au/afr/PrintArticle.aspx?doc=AFR%2F2022%2F05%2F27&entity=ar04300&mode=text

[5] Source: Sier, J.; et al; Crypto meltdown after $26b terra collapse” – The Australian Financial Review, 13th May 2022. (See: https://todayspaper.smedia.com.au/afr/PrintArticle.aspx?doc=AFR%2F2022%2F05%2F13&entity=ar00102&mode=text

[6] This interpretation of the question is based on the discussion article “What of bitcoin went to zero?”, The Economist, 7th August, 2021, 56-57.

[7] Kharif, O.; “DeFi panic as crypto liquidation risks mount”, The Australian Financial Review – on-line 20 June, 2022 (4:02 pm (AEST)) https://www.afr.com/markets/equity-markets/defi-panic-as-crypto-liquidation-risks-mount-20220620-p5av25 (First Published by Bloomberg).

[8] Chipolina, S.; et al, Crypto exchanges slash jobs as market turmoil triggers downturn The Australian Financial Review, (On-line) J15 June, 2022, 4:30 pm (AEST). https://www.afr.com/markets/currencies/crypto-exchanges-slash-jobs-as-market-turmoil-triggers-downturn-20220615-p5atz8

[9] See also “Crypto: will the bitcoin dream succeed?” The Economist, 13 June 2021, https://www.youtube.com/watch?v=5tt7y0gesyo

[10] Van Rijmenan, M., & Ryan, P.; Blockchain: Transforming Your Business and Our World, Routledge (Taylor & Francis Group), 2019., p.13.

[11] “The cryptocurrency sell-off has exposed those swimming naked”, The Economist, 19th June, 2022, https://www.economist.com/leaders/2022/05/18/the-cryptocurrency-sell-off-has-exposed-those-swimming-naked

[12] Source: “Why crypto’s bruising comedown matters”, The Economist, 19th May 2022, at https://www.economist.com/finance-and-economics/2022/05/19/why-cryptos-bruising-comedown-matters

[13] See the discussion of Luna’s failed backing of Terra “The cryptocurrency sell-off has exposed those swimming naked”, The Economist, London, 18 May, 2022, https://www.economist.com/leaders/2022/05/18/the-cryptocurrency-sell-off-has-exposed-those-swimming-naked.

[14] Sier, J.; et al; Crypto meltdown after $26b terra collapse” – The Australian Financial Review, 13th May 2022. (See: https://todayspaper.smedia.com.au/afr/PrintArticle.aspx?doc=AFR%2F2022%2F05%2F13&entity=ar00102&mode=text

[15] The classic is the strategic partnership between NAB (Australia), NatWest (UK), CIBC (Canada) and Utau Unibanco to provide common APU (Application Programming Interfaces). See Eyers, J.; “NAB’s fintech start-up plan with global lenders”, The Australian Financial Review, 17th August, 2021, https://todayspaper.smedia.com.au/afr/PrintArticle.aspx?doc=AFR%2F2021%2F08%2F17&entity=ar01702&mode=text

[16] Regan, M.J.; “Crypto’s excruciating week has traders bracing for next crisis”, The Australian Financial Review, On-Line, 18th June, 2022 (at 1:34 pm (AEST)). https://www.afr.com/markets/equity-markets/crypto-s-excruciating-week-has-traders-bracing-for-next-crisis-20220618-p5auqh (Sourced from Bloomberg).

[17] Shapiro, J.; “What we’ve learnt from crypto’s crash”, The Australian Financial Review, 18th May 2022. https://todayspaper.smedia.com.au/afr/PrintArticle.aspx?doc=AFR%2F2022%2F05%2F18&entity=ar03500&mode=text

[18] Source: https://www.blockchain.com/charts/market-price .

[19] In Australia, NFT’s are popular for cash funds and property trust alternatives. One can expect that such NFT’s will shortly need issue offer compliant documents which may level the playing field. One of Projects RH’s clients is funding a new Hyatt hotel using NFTs.

[20] Projects RH works in Asia and we saw a significant reduction in individual Chinese investing offshore as they cannot send money via crypto – they were selling Won by coin and selling it for USD and investing. This is effectively closed.

[21] Eyers, J.; “Crypto crash: State Street says digital currency is in ‘polar vortex’ as it eyes real assets”, The Australian Financial Review, 20th June, 2022 (2:52 pm (AEST)). https://www.afr.com/companies/financial-services/crypto-in-polar-vortex-but-state-street-eyes-real-assets-20220620-p5av01

[22] The Author is currently undertaking “ he Economist Fintech and the Future of Finance: Blockchain, Cryptocurrencies, Govcoins and the Payments Revolution”, a program offer by The Economist Education and GetSmarter. (May-July, 2022). This program inspired this paper.

[12]

[12] [18]

[18]