The awakening environmental consciousness

As we emerge from the long winter of the Covid-19 world we are seeing the long winter has produced many changes. The first among these is that business has become increasingly environmentally conscious and both keen and sensitive to maintaining the faith of the investors and their clients that they are meeting the community’s expectations. There is a huge recognition within at least the upper echelons of management and in the board rooms that conducting large business requires a community social licence and a cost of this licence is meeting ever increasing expectations. The last two years we have lived with Scope 1, 2 and 3 reporting obligations and now we are being challenged by Scope 4 reporting. In short, Scope 4 calls on companies to explain why the use of their product or service vis others provides a positive long-term environmental impact. Examples include selection of concrete, office space and window glass.

Within this set of new expectations is the belief that energy companies need not only to source carbon credits but also use the best available technology to produce electricity. In Australia, and elsewhere, this has led to the early closure and announced more early closures of coal-fired power stations.[1] For the moment, the Australian thermal coal industry, has not been quick to complain as demand for Australian thermal coal internationally remains strong and prices high. Nevertheless, there is a serious change occurring in the domestic composition of energy production.

Prices keep rising, what to do?

Australia’s electricity price is set across a number of nodes which reflect gates supply and demand dynamics. These dynamics include the management and calling of baseload power stations and renewable energy which cannot be stored in gas-fired -both baseload and peaking. The object of the energy market is providing an efficient matching of supply and demand. There have been periods over recent years where the system has gone to 0 because of the amount of energy being produced by renewables which could not be stored at the same time as baseload power stations could not be turned down.

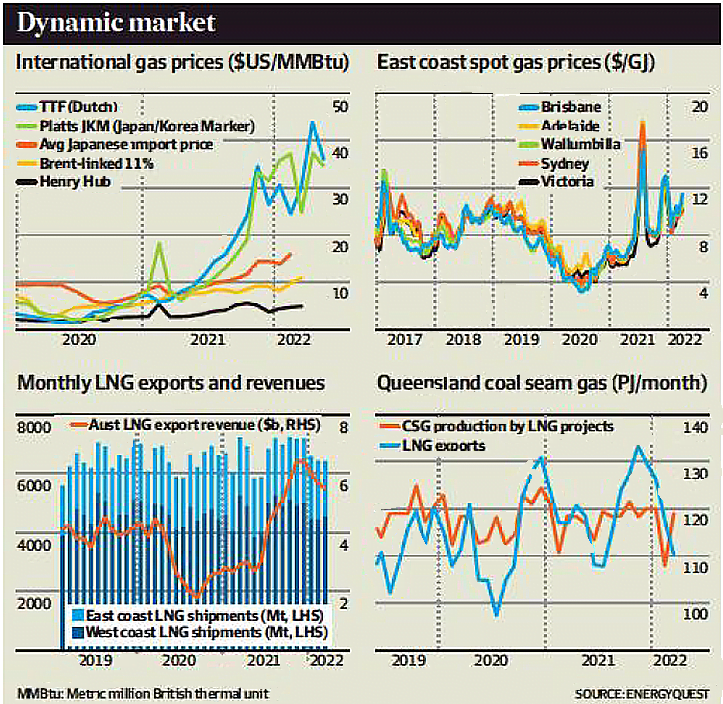

Internationally, and in the case of Australia natural gas or LNG, it is generally considered as the flexible fuel within the system. The major cost for a gas-fired power station is gas itself. For a gas-fired power station to come online there needs to be sufficient margin in what is referred to as the sparks spread to allow the cost of gas and operations to be recovered, otherwise a gas-fired power unit would not offer itself into the market. What is disturbing for the industry is, as the price of gas increases, so to then does the minimum price that the producer of gas-fired electricity is prepared to accept to dispatch power into the system.

In Australia we have two issues: first is the demand for and supply of gas and the second is the price that must be paid for the gas. Eastern Australia’s natural gas industry was not based on a guaranteed domestic offtake structure as exists in Western Australia and therefore there has never been a limit that should be reserved at a particular price for local use. Yes, it has been debated by politicians, but it never been legislated for. Effectively Eastern Australia is subject to world parity pricing and those who supply gas to Australian local consumers can easily export it.

Given that Australia requires to purchase gas and world parity prices, it is not surprising that we are experiencing an increase in price as the world, in durability impact of change in energy dynamics caused by the lack of supply being available from Russia to Europe, and the switch in supply seeing the European demand in its winter being fed by production from the Middle East, USA[2] and Asia.

In short, Australia is paying a global price for its gas and energy which puts it in the same market position as most of the rest the world. Australia is replacing some Russian gas sales in North Asia (inc. Japan and Korea).

Most consumers and small businesses in Australia are protected from price fluctuations buying contracts they have with their suppliers of electricity. It is industrial users and power generators which are feeling the impact of these prices quickly, nevertheless in the medium term the retailers will have no choice but to pass on their increase costs to consumers. In the current environment the ongoing future for coal-fired power stations and associated jobs continues to be a major issue. This is likely to intensify if there is a significant increase in consumer energy costs. The recent announcement of taking power generation units off-line and/or closing them permanently will result in less available coal-fired generation and therefore an increase in demand in gas-fired generation. In turn, this must increase the demand for gas and therefore the local price of electricity. The demand for gas and for electricity will be increased as Australia heads into winter.

What Now

At Projects RH we are working with our clients to look at strategies for managing their energy price risk. Most of our clients do not have electricity as a significant direct cost. Some of our clients are involved in continuous manufacturing and they are exposed to radical shifts in the price of energy. We are working with them to ensure that they gain an energy price insurance in a cost-effective means.

Many of our clients are now seeing that they have to manage the business in the light of a new social and community expectation that they will be responsible and accountable to a wider audience for how they source the energy they use. In short, most have committed to a net carbon zero world for 2035 but in practice want to see this in place well and truly before that date. One of our clients is involved in continuous food production exporting a significant percentage of what they produce to Europe. They are well aware that the people who purchase their product will want to talk to them about how they source their energy so that do not run the risk of having to pay an energy equalisation tariff.

Most of our clients are not seeing that recent energy prices have put them in a material disadvantage to competitors as they too are subject to the same global fluctuations in price.

Make the best of the times

In 2022 we live in a period of energy transformation. The key area of transformation is the source and distribution of the energy we need beyond day-to-day lives. We are becoming increasingly dependent on renewable energies and we will see more early closures of coal-fired power stations. Invariable consequence of this is we will need to rely on gas peaking and baseload systems. As the global demand for gas from Australia increases, east-coast Australia will be subject to increasing energy prices removing one of our business modes but more importantly one which offsets or compensates for the tyranny of distance from Australia to its major international markets.

Like the rest the world Australia will need to be smarter and how we use energy and more importantly understand where we have energy inefficiencies such as cool air leaking through poorly built houses. We will need to be smarter in all things we do and this will require investment.

None of this will be free and it’s important to understand that this will increase the cost of production. At Projects RH we work with clients to understand their energy and reputational issues, and to find the most affordable solutions to their problems. If you would like to talk to Projects RH please give us a call on +61 418 486 015.

By Paul Raftery

CEO, Projects RH, based in Sydney

________________________________________

[1] Macdonald-Smith, A., Power bosses struggle with coal exit plans – Financial Review, 4/20/2022, Financial Review – Business, Finance and Investment News | afr.com

[2] Blas, J.; Biden’s gas exports create home headaches – Financial Review, 4/20/2022 (Sourced from Bloomberg) Financial Review – Business, Finance and Investment News | afr.com

[3] Source : Macdonald-Smith, A.; Electricity outages drive up east coast gas prices – Financial Review, 4/19/2022. Financial Review – Business, Finance and Investment News | afr.com

______________________________________