From CBD to cyberlink

20 years ago, it was established orthodoxy that high-quality work needed to come from a business in a large corporate city for an academic institution also generally located in a large corporate city. As more companies established their own corporate city or campus, this training continued. In the last 10 years, we have seen the emergence of the cyberlink community, which means it doesn’t matter where you are providing your flexibility; you can join the conversation.

Tomorrow, I will start my day with a conference call with NYC, which is exactly 12 hours behind Hong Kong, and such communications are the norm. Projects RH in the United States and Colombia provided a review of materials, prepared a financial model of a copper project, plus recommendations for a copper opportunity in North Asia. Our client wanted an outcome with credible experts in an agreed time frame, which was delivered. Our team was linked to five different geographic centers, all by Zoom and WhatsApp.

During my undergraduate degree, I took a course in economic geography, which delves into why and how humans alter the environment and attempts to account for the emergence of cities. An integral factor in the rise of cities is the development of a Central Business District (CBD). Nearly all major cities and many smaller towns feature a central commercial hub where goods and services were historically sold, financial transactions conducted, and governmental proceedings carried out.

As we advance through the 21st century, many of these functions have simply been disintermediated. Most of us rarely, if ever, visit a bank branch, and when I have, I’m generally told to call the call center. We no longer deposit cash from takings, and we operate our bank accounts either online or from ATMs. These functions are widely spread. Government is something that happens in Washington, Canberra, and Brussels.

The second function of a CBD is to concentrate expertise. Increasingly, in large metropolis-style cities such as Beijing, Jakarta, and Bogota, we see people living close to work, and the city itself having multiple areas designated to be CBDs.

For Projects RH, the catalyst for dramatic change was COVID-19. Many people moved to the fringe of cities, if not to the country. Communications grew across secure channels such as Zoom and Teams, with not only business, studies, but also the courts continuing their operations through this media.

The growth of firms like Projects RH can be attributed to their willingness to embrace new technologies and work flexible hours. Modern teams consist of people with like minds.

Increasingly, people are paying for assignments. Much of the idea of secure work has gone as many of us act like consulting and professional service firms.

Cyber is the new C in CBD

Tom Dusevic in his recent article “The Big Shift at Work”, [1] has highlighted the key idea that cyber is the new C in CBD.

When I was fresh out of graduate school, working for a successful global multinational, my mentor told me that I needed to be in the office before my boss’s boss arrived, and to leave after he did. This was a common expectation at the time. I had a great desktop computer, and a couple of years later, a “luggable” computer that I could take home with me.

After a couple of years, “being seen” gave way to “what you delivered”. This is the way it should be, and I knew the company’s rituals and culture. It was still important to be in the office and even eat in the executive lunchroom – the center of offline discussions, mentoring, and coaching. I watched my mentor never sit with the same people in the same week. He worked the room. It was a great surprise to me when he was appointed as the Head of Internal Audit. His new appointment meant that if you had a concern, you could call him for assistance and know he would support you within the systems.

Over the last few weeks, many commentators in financial services have added that being in the office creates learning opportunities. However, today, the teams and learning opportunities are different. Nevertheless, most projects have a hub from which the project comes, or to which team leaders gravitate.

This age has passed, and in the West, “the company man/woman” is indeed uncommon.

The Global Experience

We are seeing that projects originate from hubs and people live where they choose but relate to a hub. The hub remains a center of expertise. Rather than going to the office, there are commonly periodic gatherings.

For Projects RH we have a global team who cater to our client hubs of Sydney, Hong Kong, Vancouver and Miami.

Cyber Town

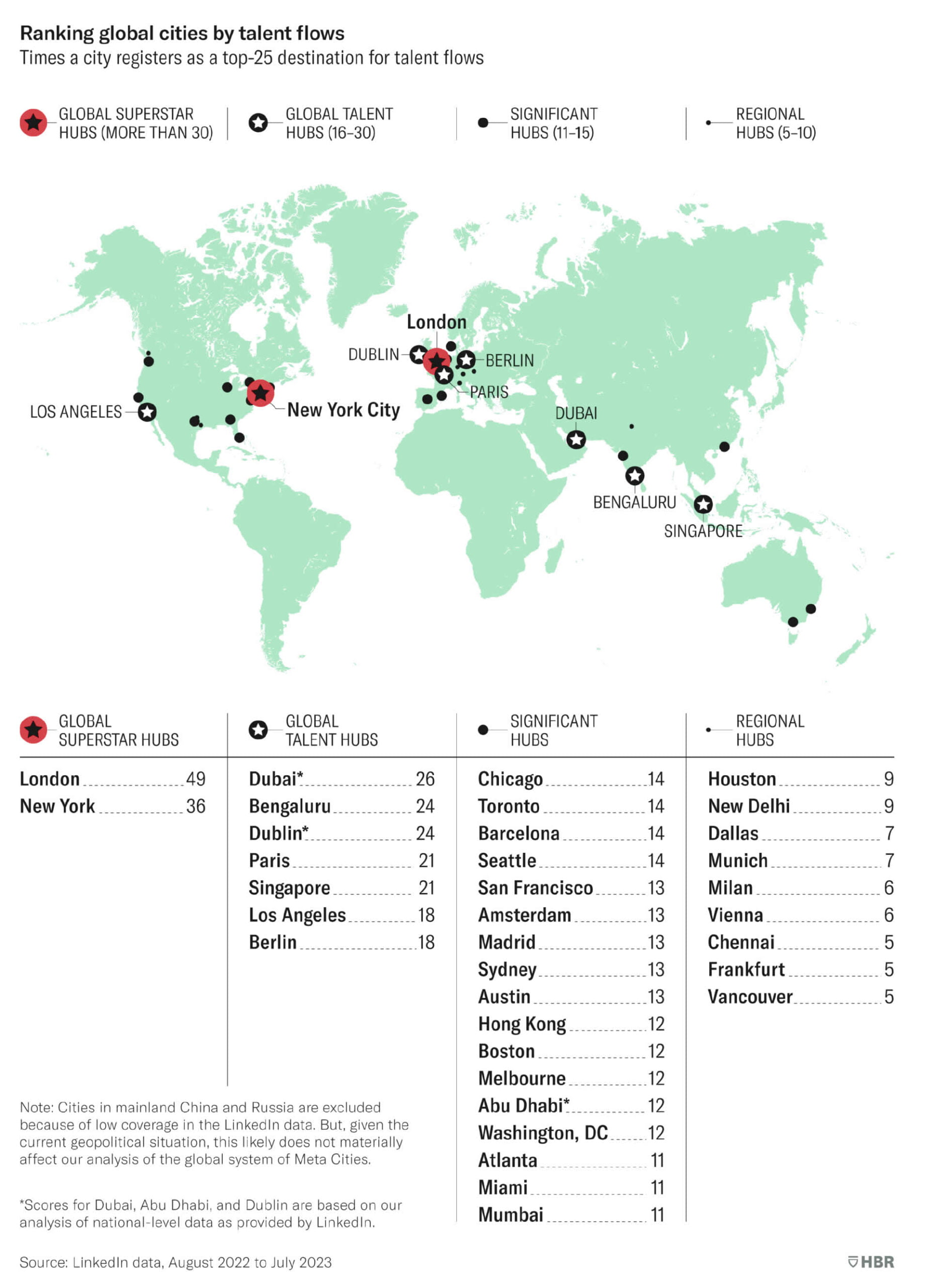

While many members of the global cyber workforce are happy to work from remote centers, many also choose to live in the cultural hubs associated with their work. This trend is reshaping cities all over the world, not just the mega centers of London, New York, Sydney, and Miami. The new population is not focused on commuting for a 9:00 AM start and 5:00 PM finish, but they do enjoy the benefits of living in a great city. As we travel, we are seeing business buildings being repurposed as high-connectivity residential spaces.

It is important to note that many people who are learning their craft and wish to undertake further studies will want to be in major industry towns. The allure of learning your craft in cities like New York, London, Bangalore, Singapore, Melbourne, or Toronto will continue. Generally, where you learn your craft will establish the value of your network, which will help you find and secure work. If you establish yourself in Toronto, it is entirely possible and likely that you can successfully relocate to Johannesburg, or even to Cali, Colombia, or Upstate New York and commute periodically.

The New Challenge

For companies like Projects RH, our focus needs to be on providing a workflow that allows our team to work from wherever they choose to live. We require flexibility in terms of when we meet and how we set deadlines. We utilize WhatsApp chat lines, Google Drive, and Zoom meetings extensively. Many of our team members work flexibly and are content.

However, some clients require us to meet them in cities, necessitating periodic domestic and international travel. Nonetheless, not all team members have to travel.

The courage of flexibility

The business paradigm has changed, and for many workers, what was originally described as the gig economy is now a reality. The new business models require flexibility and reward based on performance. It’s important to understand that our teams need a workflow. Recently, people have been employing the next generation and taking on the risk of paying them, similar to engaging lawyers and accountants many years ago. People need retainers and work fees. We need to balance our portfolio of activities to match the needs of not only our clients but also our team members.

The real question for so many of us is whether we are ready to walk into the unknown. It is no longer a choice. If we wish to prosper in these changing times, we all need to know that we need to be flexible. It takes courage, discipline, and faith in people to run a business in this new world.

Are you up to the challenge? You can start by getting online IT support.

By Paul Raftery, CEO of Projects RH.

We are happy to receive questions of comments at paulraftery@projectsrh.com

………………………………….

[1] Dusevic, T.; “The Big Shift at Work”, The Weekend Australian, 9-10 March, 2024.

[2] Table soured from Florida, R.; et al, “The Rise of the Meta City”, Harvard Business Review, 29 November, 2023 (Updated 01 December, 2023)