Down at Wanderers Club its Copper Copper

Down at Wanderers Club its Copper Copper

Recent Posts

What is a pitch deck? Complete guide to a winning presentation

Latin America and the Green Energy Transition

Is the Green Mining Revolution Turning Ore into Opportunity?

The Future of the Green Mineral Frontier

Is mining a Hero in the Green Energy Transition?

A sign of the times

The Wanderers Club in Jo’burg was the historic lunch venue for the senior gentlemen of Anglo, DeBeers, JSX,ESCom, Big Accounting, and their lawyers. It was a place where business was discussed, and notes not taken. If those walls could talk of the historic decision to relocate the Head Office of Anglo American from Mashall Street to St James, London, and that inevitably real shareholder value would be created.

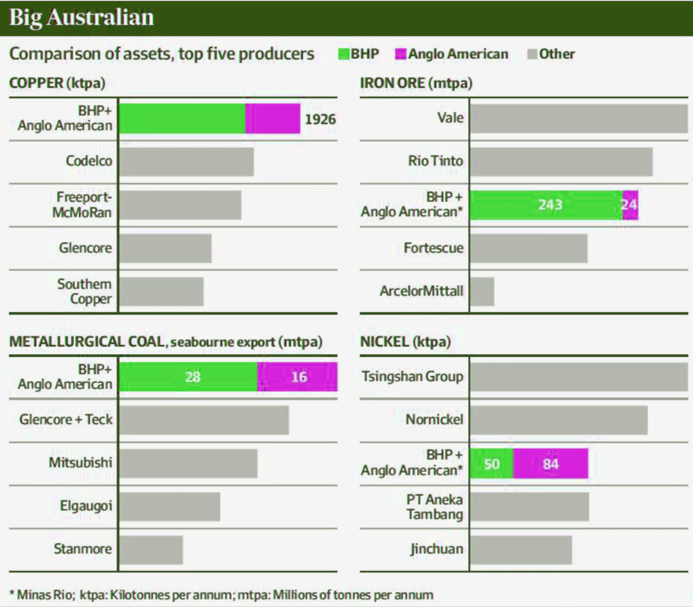

The offer of BHP to buy most of Anglo American plc reflects a clear sign of the times and BHP’s desire to be number one in the hottest mineral on the planet – copper, which in recent weeks has risen over USD 10,000 a tonne. It is well backed by the need for copper in the infrastructure to support the electrification of “things”.

At Projects RH we are working with copper, renewable energy, and battery metals companies, to provide the raw materials of the decarbonization and re-wiring of the world.

Anglo is still playing its cards, but the bold move to London some 20+ years ago was essentially to create and realize shareholder value.

BHP has long seen itself as the world’s premium mining stock wanting to have premium assets in A grade jurisdictions. It makes bold moves; acquired Billiton, exited assets as South32, made a bid for Rio Tinto, exited oil via a sale of its global assets to Woodside for script which it distributed to its shareholders. It is now time for its next big move which, if successful, would see it emerge as the global leader copper. Copper is the essential resource needed for the energy transition, also referred to as the “green revolution”.

Anglo has been focusing on energy, not on copper but fertilizer. BHP sees itself with the firepower to deliver Anglo’s fertilizer and Chile copper expansion project plus the $9bn acquisition Oz Minerals copper project in South Australia. It knows it has the balance sheet and firepower to deliver multiple complex projects.

We buy, not find

The reality of big mining, like big oil, is they do little exploration but rather, they farm-in or buy out. BHP’s recent acquisition of Oz Minerals is a case in point.

It is interesting that BHP’s offer requires Anglo to make some divestitures. BHP is not interested in platinum or assets in South Africa, so that has to go, and BHP has demonstrated since the acquisition of Billiton that it is only interested in A class assets in A class countries. Since its acquisition of Billiton and divestment via South 32, BHP has demonstrated its lack of interest in operating in southern Africa. This may be a poison pill for the deal as the Anglo board may see they need to sell out of these assets at a discount.

We were surprised Rio Tinto was not the first aggressor in this battle. We would not be surprised to see Rio Tinto make a counteroffer. With a book value of AUD 181billion (USD 118 billion) it can demand a seat at the table. Rio has a well-established copper business.

BHP is no doubt wanting the highly values copper assets in Chile and Peru with annual production of 730,000 t/pa and 790,000 t/pa..

It is a cold hard business decision:

“The combination would bring together the strengths of BHP and Anglo American in an optimal structure. Anglo American would bring its assets and long-term growth potential. BHP would bring its higher margin cash generative assets and growth projects along with its larger free cash flows and stronger balance sheet,”

“The combined entity would have a leading portfolio of large, low-cost, long-life Tier 1 assets focused on iron ore and metallurgical coal and future facing commodities, including potash and copper. These would be expected to generate significant cash flows and the combined entity would have the financial capacity to support value adding growth projects at the optimal time, while continuing BHP’s commitment to shareholder returns.”

BHP said in a statement.

Anglo makes 43% of its EBITDA from copper and 25% from iron ore plus USD 831m from coking coal – it is a good partner / target for BHP.

The BHP offer for Anglo is 9x. The fit is:

BHP offer for Anglo[1]

A hot action in a soft market

Globally the prices of resources stocks are seen to be soft with many good companies trading below their asset replacement cost. The immediate response of the Anglo American board would have been expected and no doubt is part of the strategy. BHP will be doing something which no doubt has long been considered and war gamed.

One of the stories we regularly hear at Projects RH is that the media is not interested in our story. In practice the financial press of the world focuses on the top 50 companies and will report on the top 200. It is hard for some 1800 companies on the ASX, 3200 on the TSX/TSXv, 2,000 on the NYSE and 5,200 on LSE/AIM and 3,000 on NASDAQ to get any mainstream media attention.

At Projects RH most of our clients are not in the top 200 of their market so it is hard for them to get any attention by local, let alone international media. Equally, few if any, are monitored by the local “full-service” broking community. Some of our clients do pay for research and publicity. The reason these clients turn to Project RH is that they do not have the in-house capabilities to prepare materials and they value our independent modelling plus our ability to introduce Pan Ocean Advisory with its global network of investors.

The Global Experience – Global Mines become fussy

The assets BHP has selected are for Tier 1 assets in Tier 1 countries. This approach has recently been demonstrated by Newmont's approach to gold, having completed the acquisition of Newcrest commence shedding what it did not consider to be first class assets in A grade countries. With funds raised debt can be repaid. If BHP makes this commitment no doubt it can raise additional funds and do a part cash offer.

The need for mountains of copper

As some commentators have said the main impact of this takeover is we will not see any more copper in the international markets. In the short term this is true. In the longer term however, PHP will be able to expand the Anglo business in Chile as it will be able to fund it and it will be able to grow the former Oz Minerals South Australian copper assets and no doubt it will be able to continue operations in Brazil and Canada.

The New Challenge

It is hard to say whether the rise in the price of copper has led to this action by BHP or whether the ongoing price increase is a result of the foreseen concentration of supply into the hands of fewer large producers. There is no doubt that BHP has demonstrated a willingness to take hard line mines that underproduce and invest in commodities that do not meet the required return hurdles.

At Projects RH we do not foresee an increased supply of copper for some time. We do know that copper is a cyclical commodity, but our view is, in the foreseeable future each demand will continue to outstrip supply. Our view is based on the belief that decarbonization means electrification and electrification means copper and an increased cost.

Time before the rush

The clients at Projects RH are early-stage and smaller copper and other battery mineral suppliers. It is amazing for most people that we talk about a generally soft market for resources in stock given what BHP has done. First, based on their analysis, BHP has been opportunistic, and Anglo American is focused and struggling to get investment for its fertilizer project in the United Kingdom. Second, there is no better time to strike than when your target cannot control the environment around them. Third, for BHP, with an existing market capitalization of AUD 219 billion (USD 142bn), debt of only USD 20 bn, and cash of USD 10bn, and with a Long-Term Credit rating of A, there is little doubt he could raise some cash if required.

Hopefully, the focus of the market will also be on other undervalued stocks and the market will reflect the replacement cost of assets.

Projects RH's key takeaway is that the market will correct itself, and now is the time to develop cover assets for other minerals used in the decarbonization process. Our phones at Projects RH have been ringing with mining companies wishing to improve their profile and an abundance of client queries for sales.

To you, is now the time to invest in the soft market stocks in copper, gold, rare earths, lithium, and battery materials before the rush begins?

By Paul Raftery, CEO of Projects RH. We are happy to receive questions of comments at paulraftery@projectsrh.com

.................................

[1] Prepared by Wood Mackenzie and published in 6) Thompson, B., & Fowler, E.; “Anglo American rejects BHP tilt at copper glory”, The Weekend Australian Financial Review, 27-28.

Sources:

- Evans, N.; “Anglo American Snubs ‘Opportunistic Undervalued’ BHP Bid”, The Weekend Australian, 27-28 April, 2024.

- Evans, N.; “Pay dirt: BHP’s bold bid for Anglo American”, The Australian, 26 April. 2024

- Evans, N.; “Change of management might be just the tonic for Anglo American”, The Australian, 25 April, 2024.

- Gottlieisen, R.; “BHP could land an Anglo blow on IR legislation”, The Weekend Australian, 27-28 Apr 2024.

- Johnston, E.; “Copper wars are on as BHP bets it all on Anglo America”, The Australian, 25 Apr 2024.

- Thompson, B., & Fowler, E.; “Anglo American rejects BHP tilt at copper glory”, The Weekend Australian Financial Review, 27-28.

- Thompson, B.; “BHP lobs $60b copper play for Anglo American”, The Australian Financial Review.