AI es everywhere! The use of AI in different fields continues to expand, and investors are paying attention. They have already figured out which projects they want, and how they want to invest in them. You must be ready if you want your project to catch their eye-and their wallets!

Connecting good projects with smart money

At Projects RH, we see our key job as being a part of the process that connects good projects with smart money. Our principal role is to build financial models, information memoranda, pitch decks, and teasers with our partners - particularly Pan Ocean Advisory Group - in order to introduce good projects to people with smart money and, hopefully, see project funding swiftly closed.

We do not take on all clients or people who knock at our door. We believe that if they are going to pay us and engage with a market such as Pan Ocean Advisory Group, there must be a strong likelihood of success.

Like so many businesses, at this time of year, we are looking at the projects we have closed, those we are working with, and the schedules for the new year.

What we are seeing is a common theme from investors: they like smart projects that involve using systems specifically focused on artificial intelligence (AI) to improve client responsiveness and reduce the costs of processing routine - and not so routine - questions.

We are not saying that we are not seeing a lot of good minimal opportunities, particularly in gold, copper, cobalt, and all the green metals, as well as energy and renewable energy projects.

These projects tend to have an established template and expected returns models that are understood within the industry. In the mining industry, for example, we look for projects with either a Canadian National Instrument 43-101 or JORC (2012) Port, which tells investors what an independent expert believes is recoverable from the mine project.

While there are parallels in the oil and gas industry, there are no such parallels in the manufacturing of dog food, the provision of financial services, medical technology, or artificial intelligence.

AI is a critical part of the formula

A large section of the population believes that the greatest use of Artificial Intelligence (AI) is in writing essays and speeches, as well as editing photos. However, most investors know that its application is significantly broader.

Most of us use chatbots to answer routine questions. Many websites, including those of banks, telecoms, and IT companies, are increasing their use of AI to answer much more complex issues and to provide more personalized answers.

What we are seeing is the provision of advice and services based on complex sets of data and algorithms, which are supplied by clients worldwide. This is reducing the need for individuals to repeatedly answer the same questions. We are also seeing AI-based systems that allow individuals to:

- Apply for an overseas post-graduate place and obtain a visa.

- Provide interview coaching based on prior experience and a deep understanding, not just of the candidate's resume, but also of the underlying documents such as grades, reference letters, country of birth, and profile characteristics, as well as the true requirements of academic institutions and governments.

- Use blockchain technology to locate when a brand or patent began being used.

- Measure the performance of a virus destruction system and automatically change its performance criteria when it detects changes in the environment.

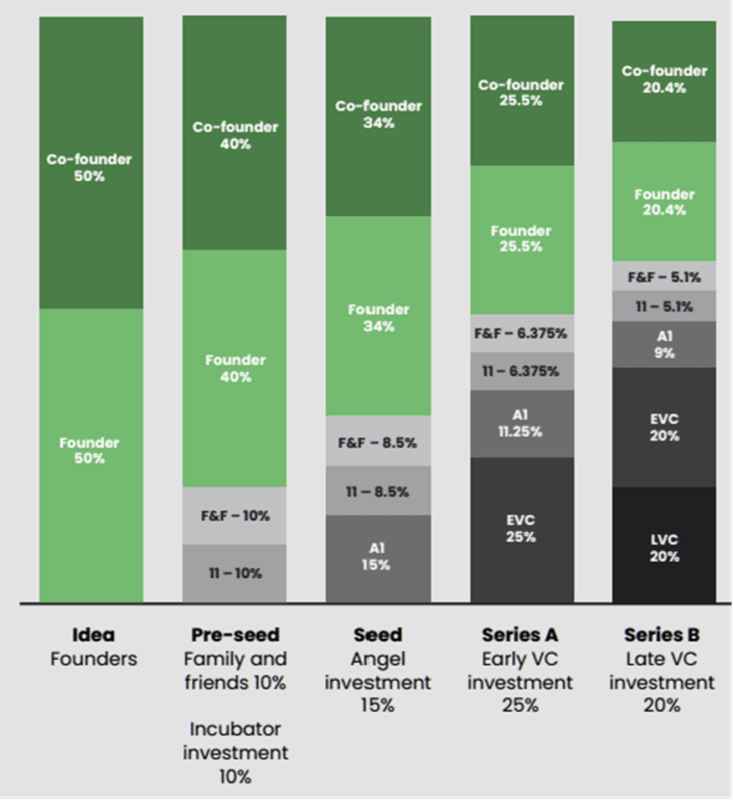

And this list continues to grow. For example, Stone & Chalk have offered this as a simple model for capital raising:

From what we have seen the founders in the process outlined below end-up with the same share but of a bigger cake.

Infant AI

In the early stages AI projects -like most technologies- find it difficult to find investors; they are like exploration companies in the mining industry. It is a specialist space and there is little money available without a high cost – for high risk. Fortunately, the infant becomes a teenager.

In the experience of Projects RH, there is a group of projects that merit - and receive - special attention. This is because the team behind the company has a deep industry experience and can demonstrate that what they are doing has a large-scale application and can enable people to make significant profit. These individuals standout when we see them.

AI in its teens

Each of these systems learns as it goes. As a system reaches what I will term a certain level of maturity, AI systems demonstrate a level of profitability akin to what was seen in fintech. We are seeing forecasted levels of profitability at the EBITDA level of 85%. If this is sustained and price levels can be maintained, AI will join fintech as a phenomenal investment.

This sustained level of profitability deserves to be exciting, and investors know it.

Investors in the process

Getting access to shares or stocks in AI has become difficult as most opportunities are being funded by wealthy family offices or individuals. Many do not want to give away too much of the business early, so they are not going to incubators.

The classic business models for investment seem to be lacking at the moment, as investors in the post-COVID world are seeking more security at each step. What we are seeing is that investors are demanding that entrepreneurs, through family, friends, and real angels, develop a minimum viable product (MVP) that can generate revenue, and then they are willing to invest.

The seed funders for IPOs are a feature of the global mining industry. These investors will fund the listing process when a company is, say, 12 months out from listing. They expect to buy their shares at a deep discount, say 50% to the IPO price, and often will want to exit at IPO. They are funding a process.

Similar investors exist in the international AI investment market. They may finance the finalization of the product and other rounds of pre-listing public funding which are common in North America. We are working with three companies in this process.

Public offers are allowed pre-listing in North America, and three of our clients are all working with regulated capital raisers - the public here gets access to pre-IPO stock dribbled out up to 12 months before a compliant listing on a smaller exchange such as the Canadian Stock Exchange (CSE) or the Toronto Stock Exchange's Venture Exchange (TXSv). Many of these companies will seek to migrate to NASDAQ because it has demonstrated repeatedly increasing shareholder value after dual listing.

The Journey and our Conclusion

For the AI companies we have worked with in 2023 the journey has begun by getting their marketing materials ready and working with a fund raiser such as Pan Ocean Advisory Group. Generally, they have had an edge in attracting a single first investor for USD 3-10m.

If your company is ready for the journey, please give me a call on +61 418 486 015 or send me an email to paul.raftery@projectsrh.com.

Whilst AI is changing our world, it is important to remember people invest in people, and our business is linking people. Whilst your team may be in slide 8 of the pitch deck it can stop an investment as investors are looking for a multiskilled team of people to deliver with the investors’ money.

By Paul Raftery, CEO Projects RH, paul.raftery@projectsrh.com and +61 418 486 015

------------

[1] Source: Capital Raising Guide for Startups, Stone & Chalk, Sydney update 2023.