Crypto, the currency of Web 3.0 – stable or buyer beware?

Crypto currencies are the financial system of various platforms which exist across the Internet and are a critical enabler of Web 3.0. Without getting into the technicalities crypto currency came into being as a reward system for enabling and rewarding organizations which verified transactions. The founders were trying to create a system which was independent, democratic, and creative records which could be a single point of truth.

For this to occur there needed to be a widely accepted method for storing data in multiple locations with independent verification of the blocks of data which had been stored and remain a template. The reward for this was a coin in the system. Rapidly these coins delivered value and became much sought after initially by the so-called “miners. Funding of the new independent, democratic, a political and geographically diversified systems was said to create a new asset class of crypto currencies which existed everywhere but were only regulated by the coin holders’ actions.

The system could be gamed in two ways. The first, the issuing of new coins beyond those announced in the first coin offer (FCO) or second by a 51% attack. 51% attack because when a party gains more than most coins and has found manipulating the market. What was a democratic system ceases to be democratic?

The week the Terra fell

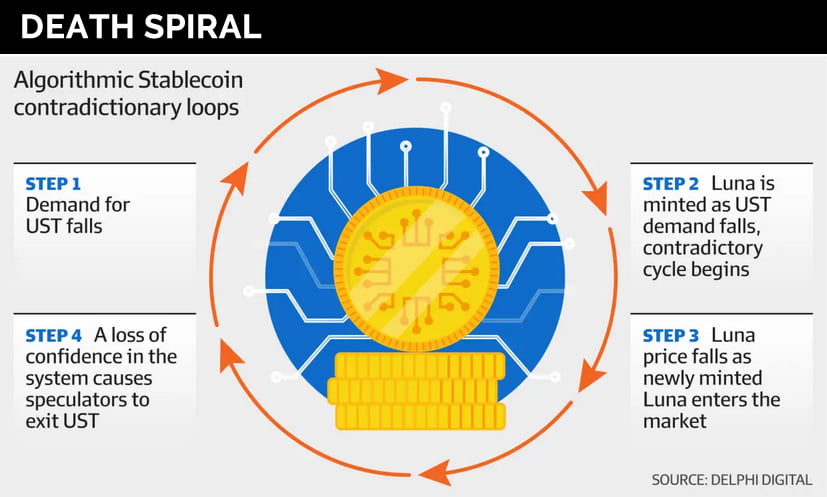

This week saw what can be concluded as a 51% attack on TerraUSD. TerraUSD was marketed as a stable coin. It was meant to be pegged to the US dollar but there had long been concerned that the underlying portfolio of assets which supported it were not as simple as U.S. Treasury bills. They argued that they needed to pay a higher rate of interest or return on investors than those securities would allow. TerraUSD was marketed as an algorithmic coin (with an actively managed portfolio to support its value). [1]

The impact of a financial attack on TerraUSD saw the coin fall from USD 1.00 to USD 0.1995. Whilst this did not impact on other stable coins it did impact across the unlinked market. Given that stable coins represent only 12% of crypto currencies the other 88% is led by Bitcoin and Ethereum receiving a 50% haircut.

How did it happen?

[2]

At the time when international financiers and markets were looking to stable coin to transfer value internationally on a cost-effective and instant basis, this represents a challenge. Only a few weeks ago the ANZ bank in Australia facilitated an investment by the Pratt family office in some $30 million by use of a stable coin.

Why Concern Now

This event saw US Treasury Secretary Janet Yellen need to plant the Senate Banking Committee on TerraUSD’s threat to the banking system. Fortunately, she was able to report that it was very small. The reality is TerraUSD is not an asset-backed stable coin but rather an algorithmic coin. TerraUSD is backed by the Luna Foundation and Do Kwon of Korea; it has an actively managed asset portfolio of non-stable assets especially held bitcoin. Investments in TerraUSD are rewarded with an 18% “interest” yield. Reasonably you cannot expect this rate of return if the underlying investment is bank deposits or US government paper.

The nature of the TerraUSD coin was it allowed redemptions into a coin at a stated rate.

The corporate backer of TerraUSD had to sell its reserve of unpegged Bitcoin to support redemptions. It was selling into a falling market and a loss in its underlying position.

Should Crypto Coin be regulated?

There are really two questions to be answered. First, should stable coin be required to be what it says it is, and should the issuing of stable coin remain like Internet banking not requiring investment documentation? The second question is: should government provide a stable coin to the market[3]. Because, as it is, Crypto, the currency of Web 3.0, is touting buyers beware.

The first question really is our crypto currency issues the issue of an investment security and if they are, why are they not regulated like other investment securities. The US State of New York clearly sees the issue of crypto in all its forms to be the issue of security and require special licensing. Many will argue that crypto did not come from this route and was a fee-for-service.

The second question about central banks issuing stable coin raises many issues and solves some. For the banking sector question becomes what their role will be as one would quickly suggest most citizens would want an account with the central bank to hold their money. This can be overcome by simply appointing the banks as the agents and not making direct access possible to individuals or companies. The advantage is clearly the tax authorities will have access to all records to verify all transactions. If you believe in a fair tax system, then this should be an acceptable price as today are bank records are checked by the revenue authorities in most jurisdictions.

At Projects RH we support a blended approach which sees mass crypto currencies as a security which is tradable and portable. It therefore should be subject to some type of short formal offer document which could be available online which confirms that the parties do understand the hazard of investing. It should be no more complex however the buying is on the stock exchange with your account at a provider of broking services. Next, we see the ideal system would see a central bank issued stable coin which would be sold and managed by accredited and regulated deposit taking institutions.

What is evident is that today the fall of a relatively minor unregulated stable coin did not have an impact on the US economy, but as crypto currency grows in significance and leading coins such as Bitcoin and Ethereum become an important part of the international banking system, an event such as this were to occur again, it may be more significant. What is required is the promotion and clear marketing of truly stable coin backed by government securities and bank deposits versus actively managed portfolios trying to replicate a stable position.

What is clear to Projects RH is that a largely regulated truly stable coin sector would make the role of AUSTRAC easier and that of the ATO more effective. Many transactions in Australia would use AUD widely distributed systems, ledgers, and blocks but clear monitored and open to scrutiny. It would discourage the use of digital currencies for financial crime in all its forms.

In a perfect world, the term stable coin would be limited to those funds backed by sovereign securities and cash. If the term stable coin cannot be limited to these funds, then fund using algorithms must be distinguished as consumers continue to be easily confused. Crypto currency is no longer the domain of a relatively few technical experts, rather it has spread to the community and is widely held and traded by consumers. It has been crypto currencies own success which has loaded it into the hands of consumers and therefore the need for regulation.

Conclusion

Those who invested in algorithmic stable coin where clearly chasing the yield difference between it and cash / government security backed stable coins. Most people would see this significant increase in yield as indicating a level of risk. The successful spread of crypto currency into the community will require governments to introduce regulation.

What is clear is that all stable coin is not the same and that investors or people using crypto currency as a medium of exchange, or the story of wealth, need to understand what they are investing in. Until there is a central bank issued truly stable coin the purchase of crypto currency is a classic case of caveat emptor – buyer beware.

By Paul Raftery, CEO, Projects RH, based in Sydney. May, 2022.

——————————————–

[1] Source: Denton, J.; “Cryptocurrency’s stablecoin proves to be anything but”, The Weekend Australian, 14-15 May, 2022, p. 31. – Originally published in Barron’s as How a Digital Token Designed to Be Stable Fueled a Crypto Crash (See: https://www.barrons.com/articles/bitcoin-prices-plunge-crypto-crash-51652342984).

[2] Source: Sier, J.; et al, Crypto meltdown after $26b terra collapse – Financial Review, 5/13/2022, https://www.afr.com

[3] Eyers, J.; Stablecoins need regulation: RBA – Financial Review, 5/14/2022. https://www.afr.com