Foreign Investment in Australia- the new playbook

Foreign Investment in Australia- the new playbook

Recent Posts

Foreign investment has been an integral part of the ongoing history of Australia since modern Australia commenced with the arrival of the “first fleet” led by Governor of Arthur Phillip in 1788. Modern Australia had a very different foundation from that of Pennsylvania or Virginia. Modern Australian origins were in essence part imperial expansion by the United Kingdom and part addressing the social needs of what to do with petty criminals. Transportation to Australia was really a one-way ticket. Early colonial Australia saw a lot of development and it was nearly all manual work.

The early colonies, which in 1900 formed Australia, whilst grew some food, were generally supported and funded by the United Kingdom government.

Background / History

Early investment in Australia, and the recurring theme for at least the first 50 years, was the development of a penal colony of New South Wales which later broke into the colonies of Tasmania, Victoria and Queensland. Australia had no East India Company and yet effectively saw early investment in the quick development of its first industry; merino wool.

Up until that, and probably well after, the passing of the Statute of Westminster 1931 -which gave the dominions of Canada, Newfoundland, Australia, New Zealand, South Africa and Irish Free State relative independence- Australia and its states saw themselves as part of the British Empire. With trade being predominantly within the English-speaking world.

WWII fundamentally changed Australia and its perception of its place in the world. It quickly recognised it was located in Asia and that it needed to be part of the world. Its population and cities grew rapidly and is economy change substantially. Much of this change was funded by foreign investment. Post WWII saw significant investment not only from Europe but also from North America.

Modern Australia

From its very beginnings Australia developed on the back of foreign investment. Today that investment is said to be AUD $4 trillion (See Appendix B).

The Australian government actively seeks new investment in areas where they recognise that Australian institutions and individuals cannot meet the demand for investment to realise Australia’s potential. These areas include:

- agribusiness and food

- digital economy

- major infrastructure materials

- science and technology

- medical science and technology

- resources and energy

- tourism and leisure

- Northern Australia

The question often asked is why Australian funds and its companies invest overseas when there are such wonderful opportunities in Australia. Fund managers, including Australia’s future fund, need to have geographical and sectoral diversity to provide stability to the fund. Australia’s leading companies, at least until the 1980s, were in the resources, banking and agricultural sectors. Like most companies, they are specialists and sought to expand in other markets. In turn, Australia attracted a lot of investment into sectors it did not have traditional expertise in, such as equipment manufacture and supply of consumables. In short, both Australian companies investing abroad and foreign companies investing into Australia, sought not to have all their eggs in one basket and it is important to remember the Australian basket of opportunities is not representative of the global economy (See Appendix A).

One of the advantages of having international investors into Australia is that by also bring with them technology, training and systems.

FIRB

Australia has long thought to encourage foreign-investment-balance; between welcoming it and ensuring it is invested in the nation´s interest. What has been critical for successive governments is to ensure that the community supports the ongoing foreign investment. Which is a competitive market in Australia. The country feels that it needs to be neither behind or ahead of the game; it looks at developments in other places like UK Japan and New Zealand.

Like most developed countries, Australia has wanted to ensure that foreign investment is in its national interest. Australia instituted the Foreign Investment Review Board (FIRB) in 1975. FIRB reports to the Australian Treasurer who approves or not its recommendations.

Events of 2020

Whilst at the time of writing, the Australian dollar is trading at USD 0.70. The events associated with the impact of Covid-19 saw Australia’s commodity prices and currency gyrate, hitting USD 0.55. At this point of time there was deep concern that international investors would quickly recognise how cheap assets were in real terms given the expected recovery of the Australian dollar to travel between USD 0.65 and USD 0.75. The reaction of the Australian government was to announce legislation would be introduced with retrospective effect the date of announcement:

- all foreign investments will be subject to review by the Australian Treasurer.

- There should be a national security test of foreign investment in what are now considered “sensitive national security businesses”; this reflects the modern society and is focused on:

- the defence supply chain

- telecommunications

- critical national infrastructure including energy and utility assets

- the Treasurer will be able to permit investments on terms to be angry with investors into sensitive national security businesses.

- Imbalanced passive investments have been streamlined in recognition that Australia competes for global capital

- institutional funds even though they have small amounts from government will be treated as non-sovereign investors.

- Additionally, new investments made after the date of announcement can be directed to be divested, in normal markets, because the area of the investment is now considered to have become a ”sensitive national security businesses” area for the Australian economy.

These terms of investment bring Australia into line with other advanced economies which also welcome foreign investment including but not limited to the UK, United States, Canada, Japan and Germany.

Conclusion

Australia has long recognised that it is in the global market for investments and that its own people cannot fund all the investments necessary for this rapidly developing country. The government continues to review its tax rules to ensure that is globally competitive and provide special incentives to encourage investment when it believes this is important. Foreigners still have access to investments through funds which receive favourable tax consideration, even by global standards.

Having worked for international companies, my experience in dealing with FIRB has been that it is quick to recognise projects which are truly in the in the national interest – which create jobs and wealth in Australia. Our experience has been: if you can demonstrate you will create jobs, comply with the law -including environmental requirements, contribute to the development of the country and eventually pay tax; that foreign investment is welcome.

Australia remains welcoming and wanting foreign investment.

China : A Postscript

In the last couple of weeks direct foreign investment from the People’s Republic of China and its state-owned enterprises has attracted an unusual and unwarranted amount of media interest.

Australia exports about AUD 79 billion basically of raw materials (iron all, gas, and coal) to China. In the services industries Australia exports education and tourism.

Today China is a key export market for Australia and is our largest source of imports. China takes 30% by value of Australia’s exports and we import 22% of our imports from China. On anyone’s calculation primer face this is a good relationship. Naturally China would like to see it more imbalanced.

Source AFR on Line of 30th September, 2019, viewed 13-06-20

Australia sells$79.9% of its exports to Asia of which China is 32.7% -calendar 2019.

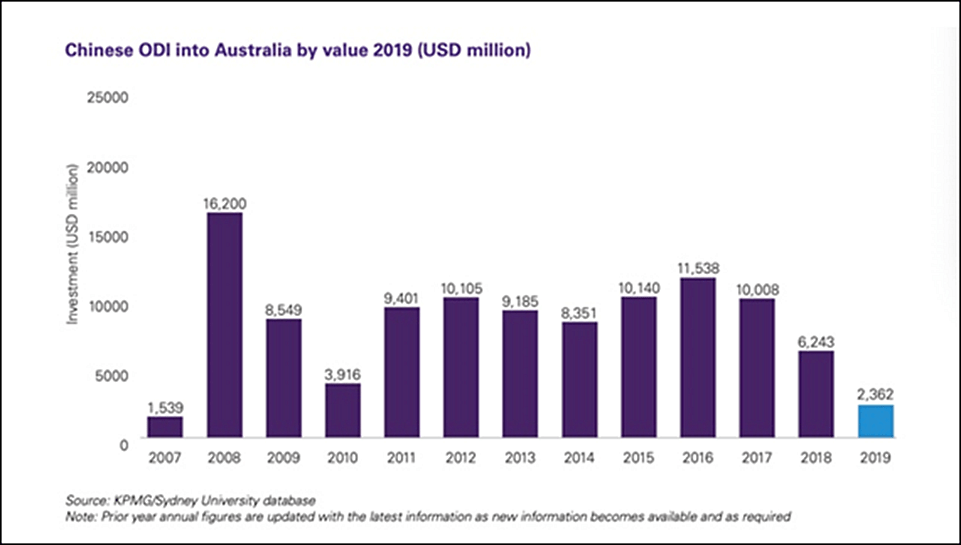

In some quarters it has been suggested that the additional FIRB rules were directed to China. This seems to be no evidence to support this. In reality looking at the numbers above: China is not a significant direct investor in Australia. Worry has been expressed that it may invest in specific industries which are considered a defence concern for Australia. Other than its offer to invest in and supplying telecommunications infrastructure, 5G, there is no evidence to suggest China has sought to invest in “sensitive” industries. China’s most recent significant investments in Australia have been dairy products and mining.

Australia has not been a significant investor in Australia as the table below demonstrates. In total its investment represents less than 1% of the USD 4,000 billion of direct foreign investment into Australia.

There has been some debate about Chinese investment in the Port of Darwin and to the government of Victoria signing to receive funding for road infrastructure as a Belt and Road initiative (OBOR). The Port of Darwin is not a key strategic port in the export trade, though it does have a small naval presence, and the roads proposed in Victoria will be very hard footage for any investor to remove.

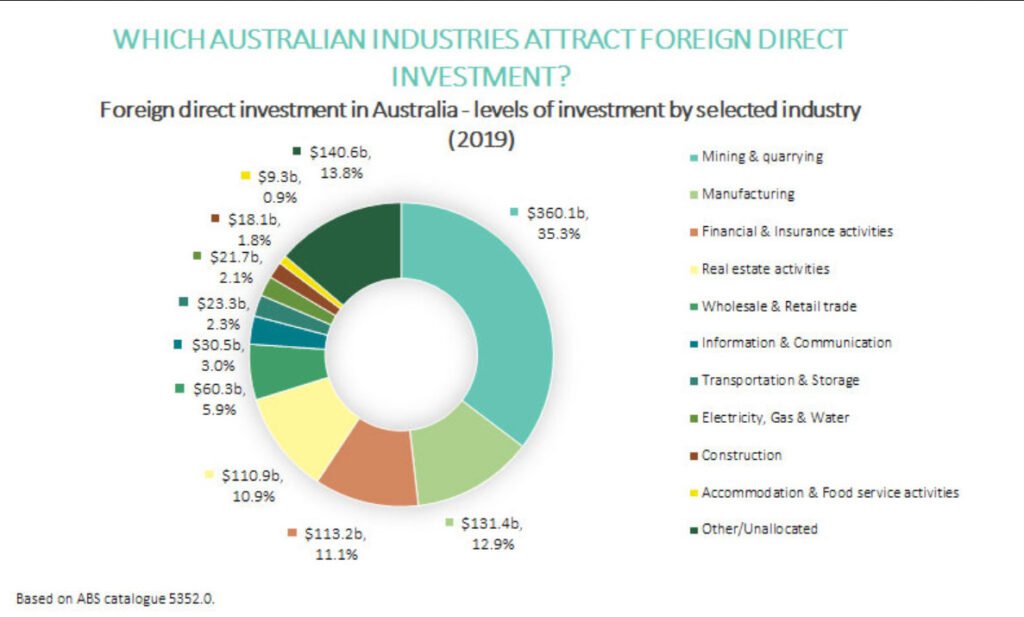

Appendix A : Which Industries Attract foreign investment

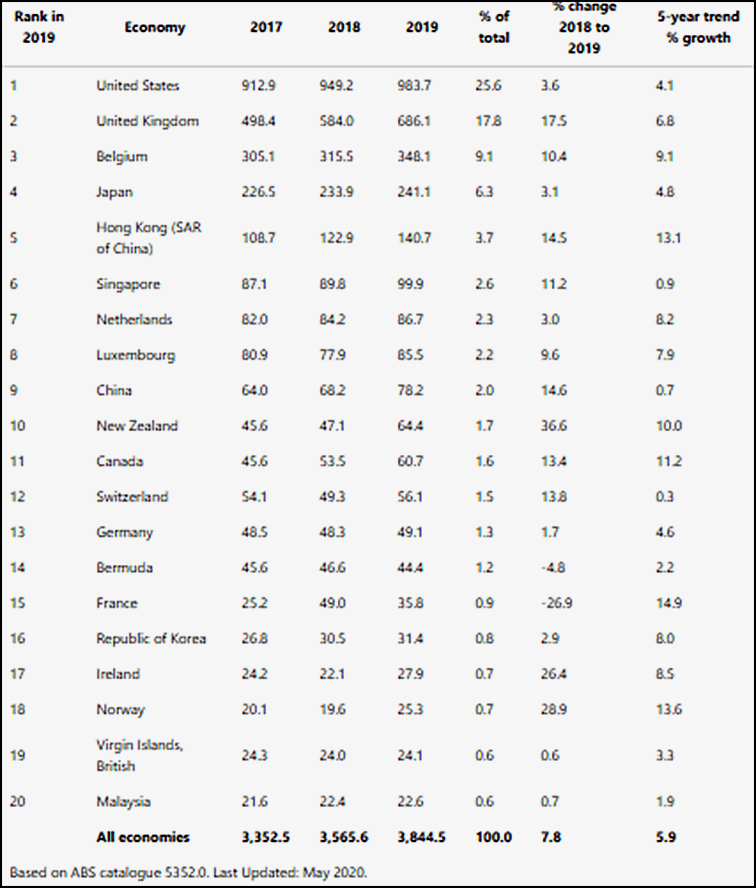

Appendix B : Which Countries Invest in Australia