Does mining have a future in decarbonization?

As I reviewed our work-in-hand and pending lists, I was surprised to see that mining is back; the geographic diversity of our mining activity returned to usual levels, having gone nearly to zero during Covid-19. The countries include Australia, Canada, Chile, Colombia, Ethiopia, South Africa, and the USA. The commodities we extract are industrial minerals, gold, and building materials.

Over the past few years, there has been a growing emphasis on the importance of recycling and transitioning towards a greener planet without relying on mining. However, it is important to recognize that not everything that is mined and processed can be recycled. To achieve a greener environment, we may need to increase mining activities, potentially on different materials.

Mining is, by nature, an extractive industry that uses up the resources it uncovers. Therefore, it is always looking for new economic deposits of whatever is in demand. What is in demand has changed, leading to vast investments in new projects.

In recent years, we learned that just-in-time management is not always best for protecting our businesses and the economy at large. Global sourcing was also a popular concept; however, Covid-19 reminded us that sea lanes can face disruptions, not only by war but also by viruses.

The ongoing war in Eastern Europe between Russia and Ukraine has caused supply chain issues, not only in food and timber but mining too. Strategic minerals are becoming increasingly critical to military supply requirements.

These factors are prompting nations to look for local approximate supplies of critical minerals needed to produce renewable energy and electronic transportation, necessary for decarbonization.

It’s where you find it

For more than 20 years of my life, I worked in financing energy and mining projects and our focus was mainly on offtake agreements from various parts of the world. Three key reasons for investing in places such as Australia, Canada, Poland, and Latin America were:

1) They possess quality sought-out resources in large quantities.

2) These countries allowed foreign investment and offtake agreements.

3) Minerals and other resources are not evenly distributed – as they say in the trade, “… it’s where you find it.”

In the last 15 years, we have witnessed a considerable change in what is regarded as strategic or critical as we move towards decarbonization.

The past is future?

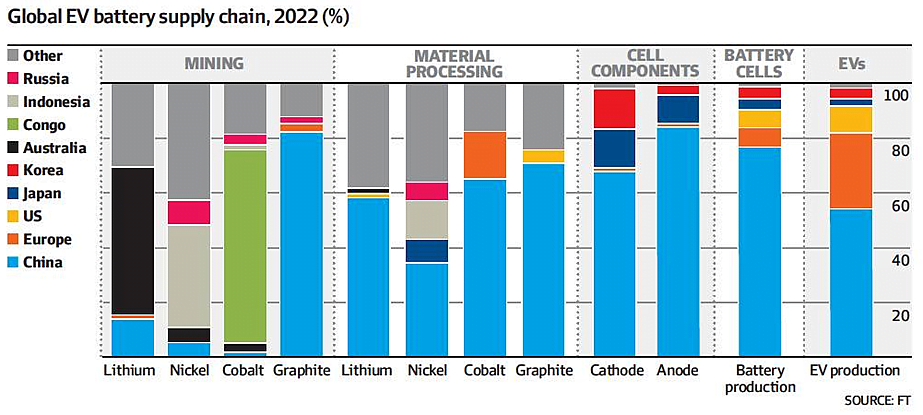

The shift towards decarbonization has led to a surge in demand for minerals required for battery production, making batteries a crucial strategic asset for nations. The ability to supply and build batteries has become critical for most countries. However, to achieve this, nations need to have access to raw materials and the capability to process them domestically. Several minerals are required for battery production, making it imperative for countries to have access to them within their borders. Nations are now investing heavily in securing their supply chains and developing domestic processing capabilities to ensure they can keep up with the growing demand for batteries. Therefore, the ability to produce batteries and related materials will become a significant factor in global politics and economic strategies in the near future.

In the world of Projects RH, we are witnessing considerable interest in mining and processing the minerals listed above, including copper, gold, and silver across Australia, Canada, South Africa, and Latin America. Most of the activity we are seeing is in junior companies that are moving into feasibility and production. There continues to be significant interest and investment from the usual markets of Canada, Australia, London, and Frankfurt. However, investment is not limited to these regions; we are seeing investment coming from across Europe, the United States, and Asia.

The investments are being made subject to commonly used international reporting criteria such as Canadian National Instruments and Australian JORC and ValMin codes. These standards are well understood by international investors. However, what is interesting is that some of the international investors have shifted their focus to include battery manufacturers, heavy engineering companies, renewable energy producers, and car companies.

Being In Transmission means going first

It is well-established in mining that the easiest projects go first, and they normally have the lowest unit cost. So, it is logical that now is the time for companies to seek investment to ensure they have a supply. All that companies want is to secure their supply. Within the world of big mining, major companies are buying resources and reserves again as they can see years of sales at premium prices.

Mining is critical to our future

Mining is back on the front pages of global newspapers because it is critical to our future. As the world moves towards 2035 and the vision of decarbonization and renewable energy in a relatively short term, this short-term change will most likely occur in the technologies we have now. Of course, there will be some refinements.

The technologies we have today will need to be built in large volumes. For example, we can expect to see the entire motor vehicle fleet of the world replaced with electric cars, buses, and trucks, and each of these will need batteries made up of minerals that generally can’t be reused.

To engage in this transition, the materials will need to be made from the resources found now to make them in the next five years. If we look at mining as requiring environmental permitting, design, and investment approval, construction, commissioning, and then entering production, we have little time to waste.

Therefore, those projects that are more developed will be the first to market, and there will be a premium paid to have control of those projects and receive the first production. We can expect to continue to see mining on the front pages of newspapers as producers seek to be the first to market and meet the demand of our community.

By Paul Raftery – CEO, Projects RH, based in Sydney.

If you have any questions www.paul.raftery@projectsrh.com or +61 451 523 547.

——————

Sources:

- Ker, P.; “BHP wins big backers for OZ acquisition”; The Australian Financial Review, 4/11/2023.

[1] Dempsey, H., and Cotterill, J.; “CHINA WINNING LITHIUM RACE”, Financial Times, 4/11/2023