The advanced economy of Singapore: the heart and soul of Asia

Singapore us a truly wonder nation but it is far from a free market. Local banking is dominated by three local banks (DBS, OCBC and UOB) plus two London based Asian focused banks HSBC and SC, plus Citibank (SC is now moving is Asian HO from HK to SG and HSBC has commenced a like process). The state has a major investment in each of these banks either via the pension system or the sovereign wealth fund and direct investment. It also controls Singtel, Singapore Airlines and Capita Land. As CEO of Projects RH, and specialized in Project Management and Investment Banking, and having lived and worked there, it is a highly compliant environment. Being a bank in Singapore is a social license with responsibility.

Singapore is seen as a major finance center securing the wealth of Indonesia, Malaysia and much of SE Asia. It is a business and finance education center. It wants to be a center of innovation.[1] In 2015, MAS established is FinTech & Innovation Group (“FTIG”) to encourage innovation and assist to find it.

In May 2016 the FinTech Office was established jointly by MAS and the National Research Foundation. This is art of the “Smart Nation” initiative.[3] Its intention was to be a “one-stop shop” for fintech’s. The initial approach to regulations has been to allow innovation until it needs to be controlled. There has been a clear application of “Sandbox Rules”. Access to this regulatory holiday was eased by the Sandbox Express rules in 2019. Under the Payment Services Act of 2019 MAS regulates payment and transfers but can encourage product development under the Sandbox Rules. The MAS has a lot of “moral suasion”.

The finance crises if 2008-09 cemented the national view that “banks” have a social license and must be highly regulated with Singapore applying strict APL and KYC rules. They are too important to be allowed to fail. In 2008-09 the Government provided the 5 with investment and local liquidity even if HSBC said no. Non-banks are regulated (licensed) according to their activity with very heavy penalties for breach with a high level of director personal responsibility.

Singapore is invested heavily in technology innovation and development, yet regulation is seen as critical ACRA, MAS, CCS ABD, CPFTA. In Singapore banks receive holistic regulation and other participants in financial services are functionally regulated. Banks are encouraged to co-operate to allow innovation. Non-banks are activity based regulated.[4] Banks are providing the “rails” and stability to the system effectively whitemailing their services and funding warehouses as SC has provided for Atome Financial.[5]

Legislation and regulations have been updated to meet policy needs.

In the case of Singapore fairness in competition is only one of the points which needs to be considered. In Singapore, like most advanced Western Societies, the stability of the financial system remains a high priority. An essential part of Singapore’s rapid growth post-WWII has been the reliability of its financial and wealth management systems. In years of instability in the countries around it, Singapore has been an economic and political rock with one party elected to power for the last 50+ years.

In 2008-09 Singapore Inc (the government and its associated entities) rapidly ensured that the Singapore and regional financial local and trading systems stayed stable. In Singapore big is beautiful so the government supported its big 5 (DBS, UOB, OCBC, HSBC and SC)[6] like Australia (with CBA, NAB, ANZ and Westpac) and Canada (TD, RBC, Scotia, CIBC & Bank of Montreal).[7] They continued trade across the Asia Pacific.

Singapore to has seen the unbundling of financial services but there is significant investment by the major banks in innovation, financing and buying fintechs. UOB for example, is an ongoing investor in the Innovation Hub. Despite its economic significance in Asia as a major money center for investment, energy, trade… Singapore’s domestic market is relatively small, and this has allowed the MAS to work with participants in the sandbox and understand the impact of what they are doing plus its impact on the financial system and payment, in particular. Singapore’s culture adds greatly to the moral suasion of the regulator and innovators´ willingness to co-operate with the MAS. This sense of co-operation, funding and leading technology has allowed for a more flexible approach including digital banks and basically offshore controlled entities being active in the economy. Nevertheless, there have been legislative change such as the Payments Services Act 2019.

Despite the changes MAS remains hands on. The playing field is leveled as all banks need to play by the same rules and only 4 new (limited) licenses have been issued.

Innovation is managed but I such a way that Singapore remains viewed as a key center for fintech development. Developments remain in the sandbox until they grow and find a partner who reports and can carry the cost of any failure.

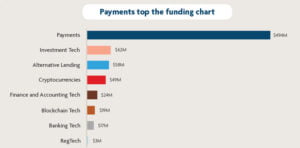

The outcome has been focused and delivered (See Tables 1), 2) and 3)).

- Most funded FinTech categories in Singapore as of 1H2021

- The 2021 Scorecard:

- Using Fintech to beat Covid-19 in Singapore

Conclusion:

The world will continue to look to Singapore as an advanced economy with its heart and soul in Asia providing the financial lead in Asia.

Until next time!

By Paul Raftery,[11]

CEO – Investment Project Manager – Projects RH, Sydney – August 2022

————————————-

[1] Fintech Laws and Regulations 2021 | Singapore, 14 January, 2022. https://www.globallegalinsights.com/practice-areas/fintech-laws-and-regulations/singapore.

[2]Source:https://www.mas.gov.sg/-/media/MAS/Fintech/ftig-covid-icons/MAS-SFA-AMTD-FinTech-Solidarity-Grant-Infographic.pdf

[3] See The Legal 500, https://www.legal500.com/guides/chapter/singapore-fintech/

[4] Fintech Laws and Regulations 2021, ob cit.

[5] Economist Education, Module 2 Unit 2 “How incumbents are fighting back”, Course Notes, 2022, p. 7.

[6] See Hawksford, GuideMeSingapore, “The Banking Industry and the Major Players in Singapore”, https://www.guidemesingapore.com/business-guides/managing-business/banking-funding-and-finances/banking-industry-and-major-banks-in-singapore

[7] See: https://www.dfat.gov.au/trade/services-and-digital-trade/australia-and-singapore-digital-economy-agreement 8 December, 2020.

[8] Source: UOB, FinTech in Singapore 1H2021: an innovation hub, August, 2021: https://www.uobgroup.com/techecosystem/news-insights-fintech-in-singapore-h1-2021.html

[9] Ibid.

[10] Source: https://www.mas.gov.sg/-/media/MAS/Fintech/ftig-covid-icons/COVID-Package-Infographic.jpg

[11] The Author is currently undertaking “ The Economist Fintech and the Future of Finance: Blockchain, Cryptocurrencies, Govcoins and the Payments Revolution”, a program offer by The Economist Education and GetSmarter. (May-July, 2022). This program inspired this paper.