Will China’s Experiment with CBDC inspire others to follow?

China[1] is a market which needs to be understood within its own political and social context. The concept of CBDC (Central Bank Digital Coin) must be seen as part of its domestic agenda – for a market of over 1 billion people. The beneficiary is the state. 1) It will reverse the growing importance of Alipay and WeChat Pay. 2) It will assist to collect more data on its people and does not want Alipay and WeChat to know more than they do. It will not be about the best technology. The PRC wants to improve its official payments system. This is a matter of sovereign pride. It is however simply e-money.[2]

China remains a nation of huge contrasts. Particularly between the coast and the west. All the major banks in China are government controlled with some exception for HSBC and SC, yet they are kept in place. China is not going to want to see its banks disappear.

Trading in global crypto was stopped to prevent wealth being sent out of the mainland.

One can expect a crypto-lite solution with simply e-money and the wallets being managed by the controlled banks. This will reduce the control and data collection by Alipay and WeChat Pay.

Having a domestic CBDC will continue to expand the Central Government’s control over the domestic economy and focus consumption on locally produced items. It will be a tool of the State.

Having a second internationally traded CBDC could be part of China’s great desire to have the RMB (Yuan) as central currency for international commerce and replace the USD as the global reserve / benchmark currency.[3]

In both cases the People’s Bank of China (PBoC) would either be the provider of the digital wallet or authorise a retail bank(s) e.g. the Industrial and Commercial Bank of China (ICBC) for the domestic coin and a commercial/trade bank such e.g. China Development Bank (CDB) for international coin.

One would expect the other major motivator would be to stop a commercial party providing a RMB stable coin outside the control of the PRC government.

Why has the PRC liked e-money[4]

- Protect the integrity of the payments system

- Allow banks to increase money for lending and restores their place as lenders

- It will help the economy and provide low-cost services across the nation

- It is difficult to counterfeit

- Cheaper to provide than cash

- Traceable

- Can be spread at a low cost by banks

- Reduce the role of influencers

- They will collect the data – data is power

It will continue to be rolled out.

Australia’s Response

Australia has an advance western baking system with an effective domestic and international settlements system. It has a high level of banking and whilst located in Asia it is a western, English-speaking country, with a Westminster government model, a legal system based on English Common Law and a central bank (the Reserve Bank of Australia (RBA)) which is based on the Bank of England model.

The Australian Dollar floats but the RBA smooths movements against a basket of currencies. This is a profitable business. The role of the RBA is in statute:

It is the duty of the Reserve Bank Board, within the limits of its powers, to ensure that the monetary and banking policy of the Bank is directed to the greatest advantage of the people of Australia and that the powers of the Bank … are exercised in such a manner as, in the opinion of the Reserve Bank Board, will best contribute to:

the stability of the currency of Australia;

the maintenance of full employment in Australia; and

the economic prosperity and welfare of the people of Australia.[7]

The RBA’s prime role is to implement monetary policy which is centred around inflation targets, credit’s availability, and high employment.

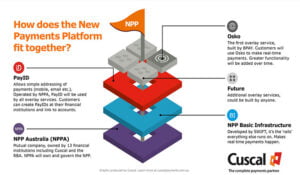

The RBA’s second role is to support the domestic economy via maintenance of liquidity and overseeing the payments system. Australia has a classic model with a real time gross settlement (RTGS) system during the trading day and effective interbank netting system 24/7. The introduction of Osko -see below- has further improved the payments system.

One suspects that given the model works and the people and the RBA’s political masters (the Australia Government) are happy there is little motivation to change it.

Privacy should be an issue, but Austrac already needs to a be advised of any “suspicious” transaction over AUD 5,000 (USD 3,500).

The real issue is Australia does not need it and who would regulate it. Big banks are regulated also by the Australian Prudential Regulatory Authority (APRA). APRA is concerned that CBDC would marginalise the (big) banks[9] and is demanding new legislation to protect them![10] The RBA is “playing” with a CBDC and ran a loan between banks as part of its test.[11]

Like most CB’s the RBA is prudent and conservative. Its charter is scheduled for review this year and with a new government after 9 years of Liberal / National Party government, the RBA and the Labor Party are likely to be cautious. Despite workshops with Singapore, Malaysia and South Africa’s CB’s Australia is likely to wait for Europe and Canada’s study, then US see what US does.[12] Australia’s CB’s Governor Dr Philip Lowe’s term is up for renewal (or not). With a planned review and a change of government he will not seize the initiative.

The ANZ Bank has minted a stable AUD coin. It was used in one transaction and withdrawn awaiting further discussion with the RBA. [13]

Deep-down the concern is that an Australia CBDC could cause a bank run.[14] What they are looking at is a CBDC for the (bank) wholesale market.[15]

The Conclusion for Australia at least

No doubt Australia will have a CBDC in the fullness of time, but the wallets or access is most likely to be via the existing banks. There is seen to be no urgency and little reason to go first.

Until next time!

By Paul Raftery,[17] CEO Projects RH, Sydney

———————————————————-

[1] China is defined as the PRC excluding Hong Kong SAR and Macau SAR.

[2] Laskai, L.; “Let’s Start With What China’s Digital Currency is Not”, Digichina, Stanford University, 8th March, 2022. https://digichina.stanford.edu/work/lets-start-with-what-chinas-digital-currency-is-not/

[3] Benzmiller, T.; “China’s Progress Towards a Central Bank Digital Currency”, Centre for Strategic & International Studies, Washington D.C., 19, April, 2022. https://www.csis.org/blogs/new-perspectives-asia/chinas-progress-towards-central-bank-digital-currency

[4] Taaffe, O.; “China’s digital yuan sets the standard for central bank digital currencies”, Raconteur, 19 April, 2022. https://www.raconteur.net/finance/digital-yuan-standard-central-bank-digital-currencies/

[5] Rooks, T.; “China heats up digital currency race with e-CNY debut at Olympics”, DW (English) on-line. 9th February, 2022. https://www.dw.com/en/china-heats-up-digital-currency-race-with-e-cny-debut-at-olympics/a-60701261 AEST.

[6] Ibid.

[7] This is in Bronze in the foyer of the RBA Building in Martin Place Sydney – Source: The Reserve Bank Board’s obligations with respect to monetary policy are laid out in Sections 10(2) and 11(1) of the Act. Section 10(2) of the Act, which is often referred to as the Bank’s ‘charter’.

[8] See https://www.westpac.com.au/personal-banking/online-banking/making-the-most/new-payments-platform/osko-by-bpay/

[9] De Kretser, A.; “APRA warns RBA digital currencies could bypass bank deposits”, The Australian Financial Review, 10 January, 2022. https://www.afr.com/policy/economy/apra-warns-rba-digital-currencies-could-bypass-bank-deposits-20220109-p59muu

[10] Eyers, J.; “APRA says crypto will force changes to the ‘regulatory architecture’”, The Australian Financial Review, 2 February, 2022. https://www.afr.com/companies/financial-services/apra-says-crypto-will-force-changes-to-the-regulatory-architecture-20220202-p59t77

[11] De Kretser, A.; “Payments reform explained: Protecting consumers, and banks too”, The Australian Financial Review, 8th December, 2021. https://www.afr.com/companies/financial-services/payments-explainer-20211208-p59fxa

[12] Eyers, J.; “Australia, US may follow Europe on digital currencies”, The Australian Financial Review, 8th March, 2022. https://www.afr.com/companies/financial-services/australia-us-may-follow-europe-on-digital-currencies-20220307-p5a2f2

[13] Eyers, J.; “ANZ the first bank to mint an Australian dollar stablecoin, the A$DC”, The Australian Financial Review, 24 March, 2022. https://www.afr.com/companies/financial-services/anz-the-first-bank-to-mint-an-australian-dollar-stablecoin-the-a-dc-20220323-p5a743

[14] Eyers, J.; “RBA digital currency could cause bank run: Lowe”, The Australian Financial Review, 9 December, 2021, https://www.afr.com/companies/financial-services/rba-considers-an-eaud-digital-currency-for-the-retail-market-lowe-20211209-p59g44

[15] Eyers, J.; “RBA says digital currency could make wholesale markets more efficient”, The Australian Financial Review, 8 December, 2021. https://www.afr.com/companies/financial-services/rba-says-digital-currency-could-make-wholesale-markets-more-efficient-20211208-p59frf

[16] Source: https://www.rba.gov.au/education/resources/in-a-nutshell/pdf/roles-and-functions.pdf

[17] The Author has recently undertaken “ The Economist Fintech and the Future of Finance: Blockchain, Cryptocurrencies, Govcoins and the Payments Revolution”, a program offered by The Economist Education and GetSmarter. (May-July, 2022). This program inspired this paper.